by MyRenoCPA | Feb 1, 2015 | Tax Planning

Are you ready for tax time? Monday, February 2nd, is the deadline for employers to mail out Form W-2 to employees and for businesses to furnish Form 1099 statements reporting, among other things, non-employee compensation, bank interest, dividends, and distributions...

by MyRenoCPA | Jan 31, 2015 | Financial Planning

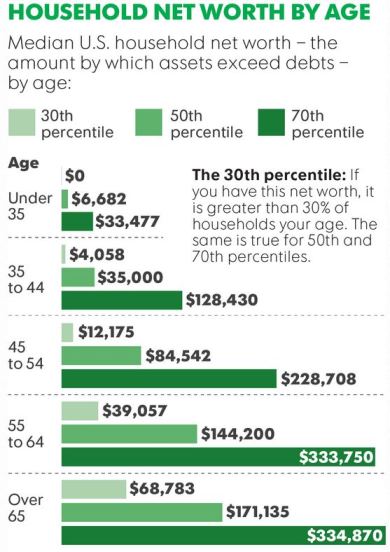

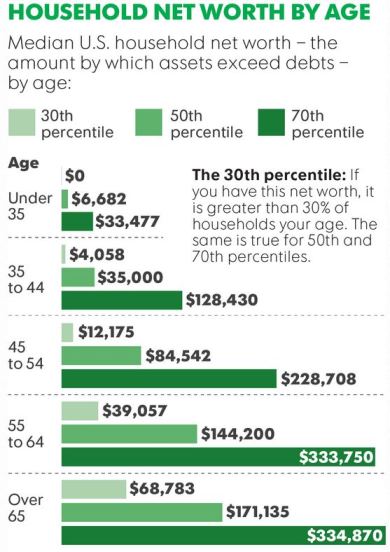

Net worth is arrived at by taking all of your assets (everything that you own) and subtracting your liabilities (everything that you owe). The infographic shows the U.S. median household net worth based on a report issued by the U.S. Census Bureau in 2011....

by MyRenoCPA | Jan 31, 2015 | Tax Planning

Choosing Return Preparers Carefully It is important to choose carefully when hiring an individual or firm to prepare your return. Well-intentioned taxpayers can be misled by preparers who don’t understand taxes or who mislead people into taking credits or deductions...

by MyRenoCPA | Jan 29, 2015 | Tax Planning

There’s good news for taxpayers: A number of popular tax provisions that expired at the end of 2013 have been extended into 2014, thanks to a new tax law passed by Congress in December. That means qualified individuals will be able to claim deductions for the state...